Changes are bringing companies face-to-face with new challenges, especially when they are as fundamental and dynamic as those in the mobility sector. They require new, innovative solutions. Since sales organizations are very close to the market and customers, SEALING WORLD spoke with the company’s two top sales executives, Ulrich Huth, Automotive Sales, and Michael Link, Sales General Industry (GI), on current trends relating to batteries, fuel cells, hydrogen and much more.

Ulrich Huth has held the position of President, Automotive Sales, since February. He grew up and attended school in Cologne and then studied business administration and mechanical engineering. Huth started his professional career at Deutz AG, where he graduated from a training program and gained his first sales experience . He joined Automotive Sales at Freudenberg Sealing Technologies (FST) in 2001, initially as a sales engineer in the Cologne field office. He gained experience abroad in Plymouth in the United States. In his first stint in Weinheim, he served as the key account manager for the ZF Group and took on various strategic executive assignments in Automotive Sales in later years. Huth is 51 years old, married and the father of two.

Mr. Huth, first, a provocative question: In the era of climate change, is the car a thing of the past?

Huth: The global auto market is growing again. The growth rate was 6 percent in 2022. This year, more cars are being built and sold globally than last year; the increase is expected to be about 4 percent. Every region of the world will be contributing to the global growth. In many countries last year, bottlenecks and limited availability were a major problem. Customers had to wait months, often more than a year, for a new car.

The supply situation has now improved. Automakers are increasingly reducing the backlog, although they are still suffering from material bottlenecks in the supply chain. Today it is inflation and rising interest rates that are increasing purchase prices and the cost of financing and weighing down the car business. But the basic situation has not changed: Production and new registrations are expected to keep climbing. The auto industry is still very attractive to Freudenberg Sealing Technologies (FST).

Giving it another try: In the era of climate change, is the internal combustion engine a thing of the past?

Huth: That’s closer to the mark. The transformation from the internal combustion engine to the electric motor is well underway in all the core automotive markets, even if its speed varies from market to market. In 2022, about 12 million newly registered vehicles were equipped with electric powertrains, significantly more than the figure for the previous year (see info box below). Even before 2035, one-half of all new cars sold worldwide will be electrically powered. Internal combustion engines are in decline but still represent a large market. Some manufacturers are ahead of the political curve and don’t really want to continue selling cars with internal combustion engines.

On the political level, the United Nations and the EU are key drivers of electric mobility, with climate objectives and bans on sales of cars with internal combustion engines.

Huth: That’s right. However, if you leave out smaller countries like Norway – where electric cars today lead the registration statistics by a long margin – China is far ahead in electric mobility in terms of the absolute numbers. In 2022, one out of every two electric cars was sold in China. Chinese companies are the leaders in the technology for lithium ion batteries. Other regions of the world, such as Europe and North America, will have to catch up first. An example from Europe: Mercedes-Benz, TotalEnergies and Stellantis, which includes the Peugeot, Opel, Chrysler and Fiat brands. among others, have teamed up to form the Automotive Cells Company (ACC). It plans to build three giga factories for the manufacture of automotive batteries in Europe.

Factories are being planned for Europe and North America but not in India or in the Far East?

Huth: Yes. Customers want “local for local.” We realize that operations are being brought back to Europe and North America, to the respective markets and to existing production facilities and end-users due to a fear of supply bottlenecks, trade restrictions and political distortions. In turn, our customers in China or India expect this from us as well. Companies in those countries also want to expand their local supply chains. But decisions on where a company builds its next battery or vehicle plant are now strongly affected by political factors such as subsidies, purchase incentives and customs duties. The age of liberalization, a global division of labor and open markets is yielding – at least in part – to growing protectionism.

Michael Link,

President, Sales, General Industry.

Mr. Link, how have the changes in drive technology become evident in the industrial business?

Link: The transformation is hitting the auto industry harder, and it started earlier there than in the industrial business. But in our business, we have to be as flexible as possible and ready to make adjustments. Before I go into the opportunities for us, I would like to briefly take up the issues of India and proximity to the customer.. One of our strategic goals in the industrial business is “go east,” that is, to catch up and grow disproportionately in Asia. We are striving for a globally balanced distribution of revenue, with one-third coming from each of three regions: America, Europe and Asia. In the seal business in large markets such as India, the emphasis has long been on low prices rather than quality. But the awareness of value, safety and longevity is growing even there. This is giving us the chance to step in more actively with our tried-and-tested products and technologies, perhaps convincing an Indian tractor manufacturer of the benefits of classic Simmerring® radial shaft seals. But we are manufacturing the products close to the customer locally, not in Europe. This is the only way we can benefit fully from India’s growth. Local production is virtually the price of admission to take part in the growth.

That means growth there does not necessarily require innovation?

Link: The key to success is an array of innovative and proven products, depending on what the market and the specific application need from us. It is often enough – especially in Asia – to make products available locally that have been tried-and-tested a million times. But sometimes more innovation is required. For example, challenging applications in automation and robotics may require especially high-performance Simmerrings, like those we offer in the form of the MMS High Speed or the Premium Sine Seal (PSS).

Let’s talk about fuel cells. What role do they play in your plans?

Huth: In our view, fuel cells are not going to make inroads in passenger cars. Nor will they find a home in urban buses or the light commercial vehicles used for a package deliveries, for example. They will use battery-electric powertrains. But we do see a trend toward fuel cells in long-haul transportation, and in heavy-duty commercial vehicles for passenger and freight transport. The technology makes economic sense in these areas. The batteries with sufficient capacity are heavy and reduce payloads. An alternative approach to heavy-duty transport is to convert internal combustion engines from diesel to hydrogen fuel.

Link: Significant options are also opening up in shipping. Environmentally neutral ship operations are a huge issue. In some cases, ports are no longer allowing ships with classic powertrains to enter harbors. The situation is similar in inland lakes and fjords. That is why powertrain concepts using both fuel cell and diesel power will also play an important role for smaller ships, in addition to battery-diesel combinations in the future. At times, the fuel cell exclusively covers energy needs on board the ship. At other times, it helps with propulsion. The field is in a great deal of flux. We are in discussions with partners on the different variations and business models. In the fuel cell field, our customers also see opportunities for stationary use, in construction management, for example. In the case of large construction sites, diesel systems provide the entire electrical supply for the first few months. Fuel cells could take on this task CO2-neutrally.

Hydrogen is considered the gold of the future. What does that mean for FST’s industrial business?

Link: We basically have two lines of attack: Seals are needed for the generation of hydrogen. This is done with electrolysis in different technological processes. The use of hydrogen also requires seals. This can take place in fuel cells. For several years, we have been providing adapted flat seals for fuel cells, for example, seals for gas diffusion layers (GDL) or for metal bipolar plates. These solutions seal the stack of the fuel cell, which is the figurative heart of the technology. Our Plug&Seal connections and O-rings are used in the fuel-cell’s surroundings, for example. We also have a series of other innovations in the pipeline (see info box below).

Besides its use in fuel cells, hydrogen can also be used as an alternative fuel in internal combustion engines. We see this trend in the off-road business, that is, in construction and farming equipment. Some of our major customers are now turning to a mixture of natural gas and hydrogen or pure hydrogen to fuel classic internal combustion engines. The first market launches will likely take place in early 2024. From our standpoint, that means we have to make sure our seals have the same longevity and leak tightness as those in a conventional internal combustion engine.

Let’s turn to the batteries for a moment: How important are they to FST?

Huth: We are going to lose a lot of automotive business due to the decline of the internal combustion engine and the units associated with it. This affects about 60 percent of our previous sales. This doesn’t mean that the business is going to completely disappear.

Until now, our main focus has been on engines and transmissions. Now the battery is primarily taking over this role. And then there are e-axles, which combine the electric motor, transmission and performance electronics in a single component. As already explained, there will be fuel cells for commercial vehicles. Two-thirds of our project pipeline already consists of pure e-mobility projects. Today we have more opportunities per vehicle, thanks to the battery, than we have with internal combustion engines. We have to be quick and flexible to pursue them because technologies and suppliers are not fixed. The competitive pressures are enormous and greater than in the internal combustion business.

Link: In the industrial business, batteries mainly play a large role in devices used outdoors, in cordless electric tools and equipment, from chainsaws to lawnmowers. For us, the issues are mainly heat management, safety, efficiency and longevity. This is where we are able to participate in FST’s developments for the auto industry. Two-wheeled vehicles are also increasingly powered by battery-electric systems, Flame-resistant materials for batteries and products such as heatshields and thermal barriers are promising topics for the aerospace industry as well.

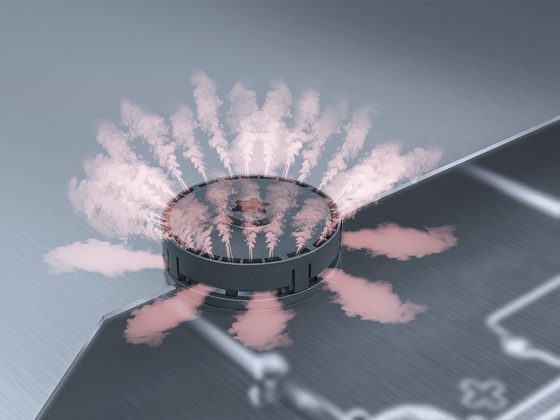

DIAvent is a patented pressure equalization element from FST that combines two functions in a single component.

What makes FST attractive for these forward-looking predictions?

Huth: At first glance, many of our new developments for batteries such as DIAvent and thermal barriers have nothing – or very little – to do with sealing technology anymore. What differentiates us is the material, design and process expertise that we have gained in sealing technology. We have a deep knowledge of applications, which helps us support our customers. This know-how is a good fit for the challenges that our customers face in dealing with electric mobility. Working in close contact with our customers, we are using this expertise to generate innovative solutions that especially make batteries and electric cars safer. The recent Supplier Innovation Award that we just received from Webasto confirms this.

Link: We innovate based on our material, processing and application expertise. That is a constant – whatever the variability in the products that we develop. In these cases, we are constantly adding to and expanding our core sealing expertise and integrating additional functions. In the process, we see ourselves as enablers, especially when it comes to sustainability. Our products make parts smaller, lighter, more cost-effective, more durable and thus more sustainable. That is the added value of our expertise for the customer.

At this point, I would like to say something about our contribution to green energy: We have a wealth of well-proven sealing solutions for climate-neutral energy production using wind power and solar technology or climate-friendly energy distribution, and we are offering tremendous new innovations in materials and design. With the help of our technology, green electricity is being produced to charge batteries sustainably and enable the production of green hydrogen.

Apart from new powertrain technologies, what trends are you dealing with in your businesses? Let’s start with the automotive business, Mr. Huth.

Huth: Electric mobility is the overarching trend in the automobile business. It goes hand-in-hand with connectivity, digitalization and automation. The key concepts here are autonomous or semi-autonomous driving and automated functions that many of us see as a natural progression. Features such as ABS, ESP, rain sensors, lane departure warning systems, adaptive cruise control, and automatic braking assistance have have even found their way into the smaller vehicle classes. Safety equipment and comfort functions – ranging from massage systems to entertainment – are becoming more widespread. This is increasing the demand for sensor systems and electronics. Here we have a wide range of solutions in our product lines. Among our classic products, we are also benefiting from the trend to automatic transmissions across all vehicle classes. We have traditionally been able to offer highly effective solutions in this field. Manual shifting will soon disappear.

And now to you, Mr. Link. What are you involved with at Sales GI?

Link: In addition to a portfolio of high-performance products, the goal for industrial business is to expand our service portfolio. Here we work closely with the valuable partners that we have in-house: the Industrial Services Division and Corteco. As an example, I would cite additional logistical services such as kitting, individual packaging and product labeling. In General Industry, we also want to take advantage of these innovative services – and do it with a regional and customer-specific approach, in the post-purchase market, for example. We’re also dealing with the question of how we can methodically strengthen the innovative capacity of our organization as a system – at a speed that keeps up with the current transformation in terms of its complexity, scope and dynamism. What new topics are important to us, what risks do they involve, what opportunities do they offer? Key resources in this area are digital systems such as SALLY, an easy-to-use tool that we will use to measure our level of customer satisfaction, among other things. With SALLY, we are going to uncover potential for improvement, precisely broken down into individual segments, applications or regions. With the systemic capture of dialogue with our customers, we are using smart systems to make customer requirements broadly visible, create transparency and develop wide-ranging momentum for innovation.

What role does collaboration play in the innovative process?

Link: The key is “Innovating Together” in a way that we all benefit. We are offering solutions like SALLY to the other FST sales organizations. In return, the auto industry has traditionally been a pioneer in technical developments that arrive in the industrial business after a period of time. The situation is precisely the same for electric mobility. That’s why we are very thankful for the interactions with our colleagues in Automotive Sales – whether it takes place through the alignment dialogues with Technology & Innovation (T&I) or through Tanja Heislitz’ specialized team in Automotive Sales, which focuses on applications (see the article on Rudolf Bott).

Finally, let’s all take a look ahead to 2050. Could you please briefly describe a trend that you foresee in each of your current areas of responsibility?

Huth: The range of different ways that we get from A to B will increase. The spectrum extends from autonomous driving in swarms all the way to drones. In short, the notion of the automobile will be replaced by the concept of mobility.

Link: Interactive robots will play a major role. Today we think of cobots as a way to handle auxiliary activities during manufacturing operations or to relieve people of repetitive activities such as assembly line work. Incidentally, we are doing this very successfully in FST plants. The application areas for cobots will assume entirely new dimensions, for example, for the care of the sick or elderly. That’s why robotics is such an important market segment to us even today.

Business in 2022

- Electric mobility continued its advance: New electric-car registrations grew by 60 percent in 2022 compared to the previous year.

- One in six passenger cars sold globally was electrically powered, with 73 percent of the vehicles all-electric and the rest almost totally plug-in hybrids.

- In China, sales of commercial vehicles declined by half in 2022 compared to the previous year. In India, they grew by 42 percent.

- One out of every two electric cars was sold in China.

- India now only trails China and the United States in terms of the size of its market across all types of powertrains.

- In Germany, more cars were sold with electric powertrains than with diesels.

- Global supply and availability issues resulting from disrupted supply chains only began to ease slowly over the course of the year.

- In India and North America, products for electric mobility accounted for one-third of new business. Two-thirds of the applications in the Automotive Sales development pipeline are for electric vehicles. In many cases, FST is not yet known in the market for these products.